automated

travel rule SOLUTION

Reduce manual errors with an automated, scalable solution for high volume crypto businesses. Pre-validate the information of your counterparties before initiating Travel Rule transfers. Transaction and Client data are automatically & securely brought together in an IVMS101 data package. Eliminate friction, reduce delays, and deliver a seamless payment experience to your customers.

TRAVEL RULE SOLUTION FOR VASPs

PLATFORM OSPREE

MODULE TRAVEL RULE

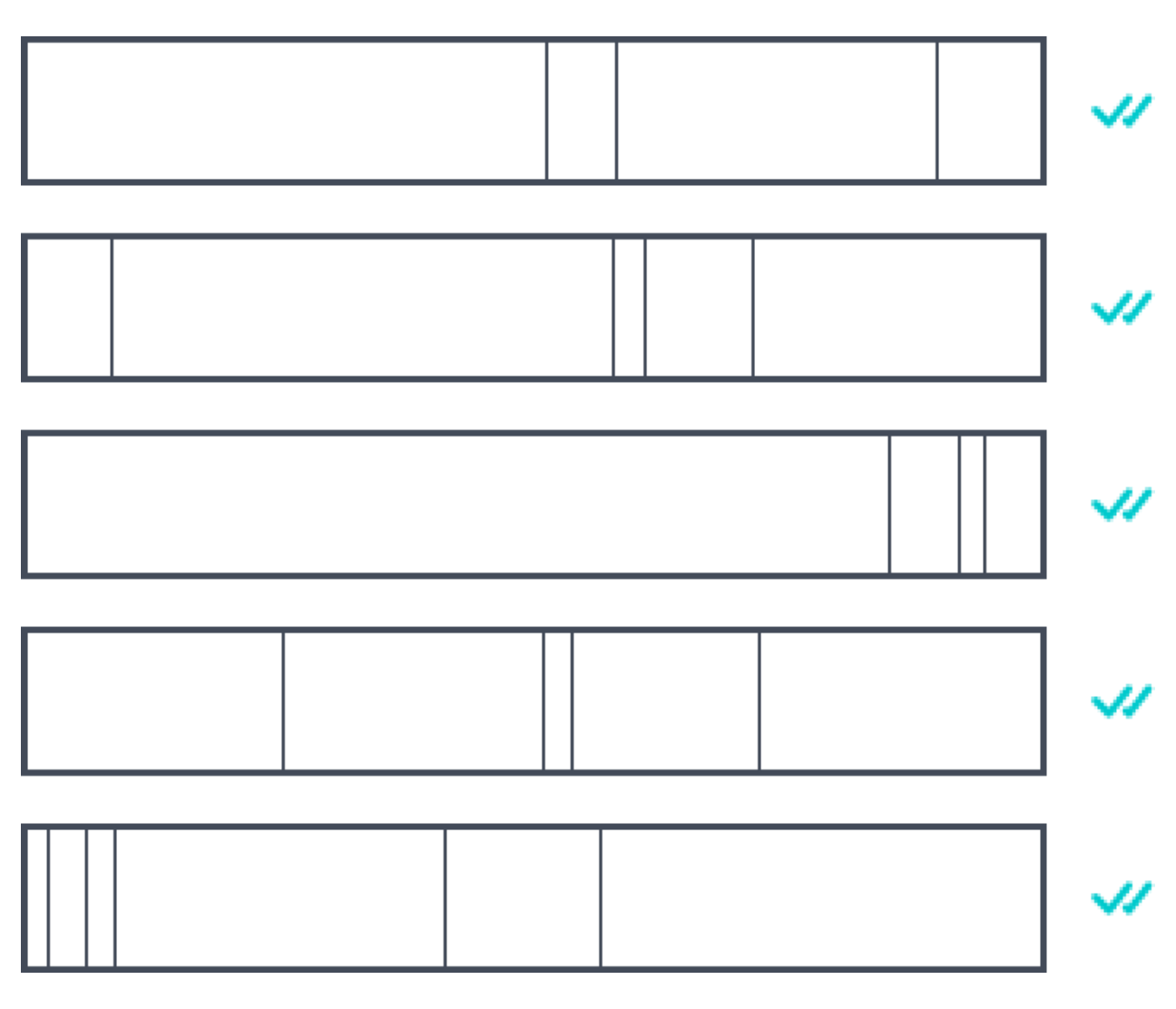

PRODUCT FLOW

Compatible with the industry-standard IVMS101 data messaging format, with pre-validation and status tracking to eliminate friction and reduce delays.

10X

faster implementation and gained efficiency

10K+

Cryptocurrencies and token supported

99.9%

UPTimE DURING EACH CALENDAR MONTH

28+

countries have daily active users in ospree

Interoperability

Transfer to any VASP, anywhere, anytime

Ospree Flow supports multiple protocols and has a backup messaging system for VASP’s who are not yet running a supported protocol or Travel Rule ready. Initiate crypto transfers without technical constraints for the beneficiary, no integration necessary.

PRE-VALIDATION

Reduce friction

in crypto payments

between VASPs

Validate the information of your counterparty before initiating Travel Rule transfers. Eliminate friction, reduce delays, and deliver a seamless payment experience to your customers.

Enterprise-grade Data Security

Read how we can help you protect your data and meet your compliance requirements.

STATUS TRACKER

Monitor all transactions

in real-time

View the progress of each sent and received Travel Rule transaction throughout the lifecycle of the information exchange.

Frequently Asked Questions

The Travel Rule as applies to cryptocurrency and digital assets is the 2019 update to the Financial Action Task Force (FATF) Recommendation 16, which requires entities that conduct virtual asset transactions to obtain, hold, and transmit required originator and beneficiary information for transactions that exceed a certain threshold in order to satisfy compliance obligations. The Travel Rule for traditional finance existed before 2019, with regulations targeted at banks and financial institutions as part of global initiatives to mitigate money laundering. Our detailed write-up on the Travel Rule is available here [link].

The FATF currently comprises 37 member jurisdictions and 2 regional organizations, which represents most major financial centers. Implementation approaches are still being considered, so each jurisdiction with its own regional regulating body has and will set its own requirements on the reporting threshold and what data needs to accompany a transaction. In other words, specific requirements related to the Travel Rule vary between countries, and crypto asset service providers are incentivized to institute robust self-compliance systems that take into consideration the different requirements of each region.

To deal with the different Travel Rule requirements in various countries, crypto asset service providers have adopted messaging “protocols” designed to aid the transfer and collection of encrypted data, including OpenVASP, TRUST, Shyft, TRISA, Sygna Bridge, TransactID, VerifyVASP, and TRP. Regardless of the messaging protocol, the crypto industry has reached a consensus over a single data messaging format, the InterVASP Messaging Standards 101 (IVMS101), for all Travel Rule protocols, which Ospree supports.

Depending on their geographical location, your counterparty will likely have reporting requirements set by their regional regulating body, based on Travel Rule recommendations and local regulatory frameworks. Not having a Travel Rule solution risks being unable to execute transactions because of your compliance status, even if the country where you are located has not yet adopted the Travel Rule.

The “Sunrise Issue” refers to the non-uniform approach to the implementation of the Travel Rule in different regions, i.e., the specific requirements vary from country to country. Therefore, crypto asset service providers need to institute self-compliance solutions that take differing requirements of various countries into account.