Navigating MiCA: What the EU’s New Crypto Asset Regulations Mean for You

Publish date: 2024-05-06 01:59 | Latest update: 2024-05-06 01:59

What is MiCA?

The European Union’s Markets in Crypto-Assets Regulation (MiCA or MiCAR), officially Regulation (EU) 2023/1114, is the first cross-jurisdictional regulatory and supervisory framework for crypto asset service providers (CASPs) operating within the EU. In conjunction with Regulation (EU) 2023/1113 on information accompanying transfers of funds, the EU’s regulatory framework for crypto sets compliance standards for anti-money laundering and counter-terrorist financing (AML/CFT), introduces a comprehensive licensing regime to enhance market integrity, and requires consumer protection measures to protect crypto asset holders. These new rules provide a clear and uniform regulatory environment, ensuring the integrity and security of the EU’s crypto space.

Key Crypto Products Covered by MiCA

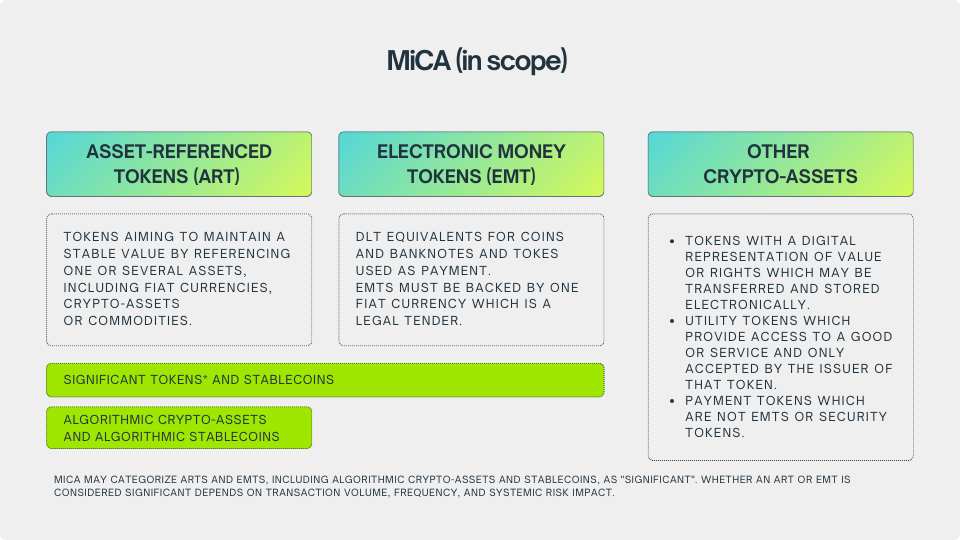

MiCA defines a crypto asset as a digital representation of value or rights that can be transferred and stored via distributed ledger technology. This regulation divides crypto assets into three categories, each with specific regulatory requirements based on their value stabilization mechanisms.

- Electronic or e-money tokens (EMTs) are crypto assets that hold value by referencing a single official currency. To qualify as electronic money, EMTs must follow strict regulatory standards, including the ability to be exchanged at par value for fiat currency.

- Asset-referenced tokens(ARTs) are crypto assets that maintain their value by referencing other values, rights, or combinations of these, including one or more official currencies. This group includes crypto assets backed by various assets, excluding e-money tokens.

- The final category includes all other crypto assets that are neither e-money nor asset-referenced tokens, such as utility tokens. These are not considered financial instruments under regulatory frameworks like The Markets in Financial Instruments Directive (MiFID II).

It is important to note that MiCA regulations do not cover all non-fungible tokens (NFTs), only applying to NFTs that resemble assets governed by MiCA. The legislation does not apply to unique NFTs.

Does MiCA Impact Your Business?

MiCA will impact a broad range of entities operating within the cryptocurrency space in the European Union:

- Crypto Exchanges and Trading Platforms: Platforms that facilitate the exchange of crypto assets for fiat currencies, other crypto assets, or digital currencies must comply with MiCA’s regulatory framework, including requirements for authorization, ongoing supervision, and operational transparency.

- Custody Service Providers: Firms offering wallet services for storing and managing cryptocurrencies, particularly where the service involves holding customers’ cryptographic keys, must ensure compliance with MiCA’s security protocols and consumer protection measures.

- Crypto Payment Providers: Services enabling businesses and individuals to accept cryptocurrencies as payment will be covered by MiCA, which requires mechanisms to prevent money laundering and ensure the traceability of all transactions.

- Crypto Asset Issuers: Entities issuing crypto-assets, including ICOs (Initial Coin Offerings) and stablecoins, are subject to MiCA’s transparency and consumer protection rules. This includes detailed requirements for authorization, passporting, and ongoing supervision.

- Non-EU Crypto Firms: Companies based outside the EU that offer services to EU customers will also need to comply with MiCA. However, MiCA allows certain exemptions under ‘reverse solicitation,’ where services are provided at the direct request of an EU customer under stringent conditions.

- DeFi Projects: Decentralized Finance (DeFi) platforms, particularly those offering services similar to regulated financial activities, may be affected depending on how their operations align with the definitions of crypto-asset services under MiCA.

- Companies Offering Derivatives and Other Financial Instruments Linked to Crypto Assets: Depending on the nature of their products, these companies may need to comply with MiCA and other financial regulations.

- Crypto Asset Advisors and Brokers: Firms providing investment advice or brokerage services related to crypto assets will also need to meet MiCA’s requirements for professional conduct and operational transparency.

The scope of MiCA is comprehensive and designed to encompass nearly all business activities involving crypto-assets within the EU. This regulatory approach ensures that both EU-based and non-EU firms engaging with EU customers maintain a high standard of integrity, security, and consumer protection. By understanding the full extent of these regulations, CASPs can prepare accordingly to ensure compliance and maintain access to the EU market.

Compliance: What You Need To Do

For Crypto-Asset Service Providers (CASPs) operating within the European Union, understanding and adhering to the MiCA regulations is crucial. Here’s a streamlined guide to help ensure MiCA- compliance:

Registration and Licensing

- EU Establishment: CASPs must have a registered office in one of the EU Member States to operate legally.

- Securing Authorization: Authorization from a National Competent Authority (NCA) in the EU is required to provide any crypto-asset services. This authorization acts as a license to operate across the EU.

- Passport Benefits: With authorization in one Member State, CASPs can seamlessly offer services across other EU countries, promoting a broader market reach without requiring multiple licenses.

Ethical Conduct and Governance

- Client-First Approach: A fundamental requirement is ensuring all operations are conducted fairly and in clients’ best interests.

- Leadership Requirements: CASPs must appoint at least one director within the EU and demonstrate that their primary management activities are based in the EU. Management and significant shareholders must also meet high standards of integrity and competence.

- Comprehensive Compliance: Adherence to strict capital requirements and robust governance, risk management, and internal organizational structures is essential for operational resilience.

Safeguarding Assets

- Custody and Security: CASPs providing custody services must implement stringent security measures for asset safekeeping. This includes segregated client holdings, daily asset reporting, and full accountability for losses resulting from operational failures or security breaches.

- Management of Client Funds: CASPs must deposit client funds with a central bank or a qualified credit institution at the end of each business day, ensuring the safety and liquidity of these assets.

Operational Resilience and Risk Management

- Effective Complaint Resolution: CASPs must have efficient procedures for handling and resolving client complaints promptly and fairly.

- Conflict of Interest Management: Proactively identifying and managing conflicts of interest is crucial to maintaining trust and protecting clients’ interests.

- Outsourcing Oversight: Monitoring and compliance with all outsourcing arrangements are necessary to control risks associated with external service providers.

- Trading System Stability: Trading platforms must establish robust operating rules and technical measures to ensure the resilience and reliability of their trading systems. They are required to ensure that the final settlement of trades occurs within 24 hours.

Timeline and Implementation

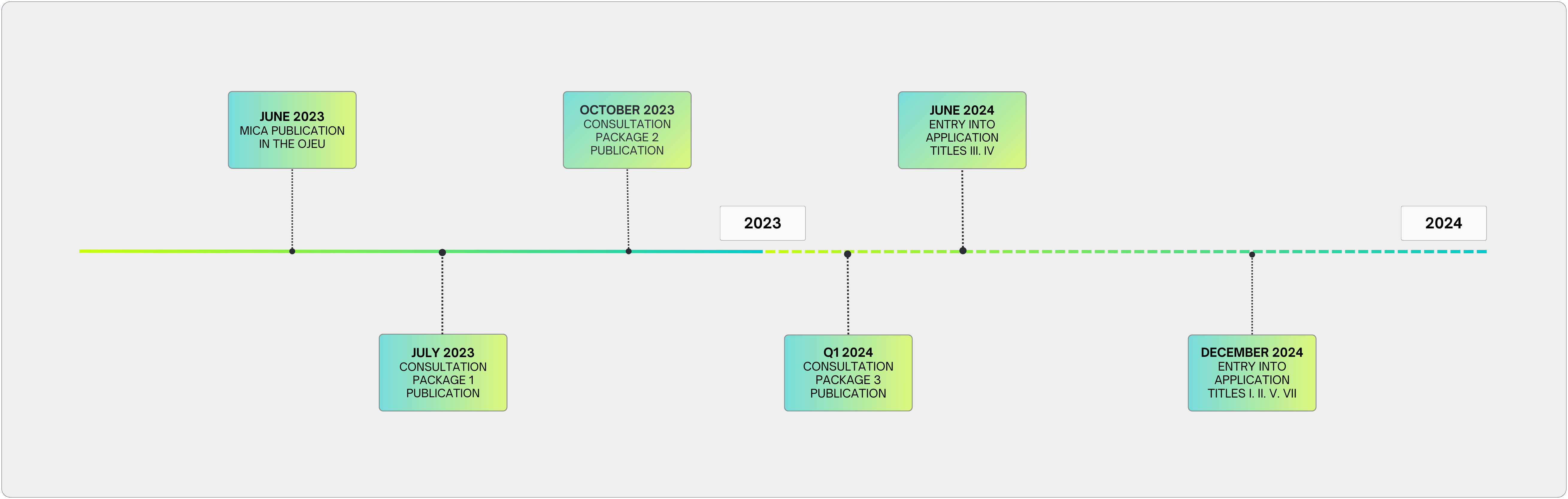

The final text of MiCA was published in the Official Journal of the European Union on June 9, 2023. This landmark legislation was enacted 20 days post-publication, with specific provisions rolling out on June 30, 2024, and others on December 30, 2024. Originating from the Digital Finance Package proposed by the European Commission in September 2020, MiCA has navigated a complex path of negotiations, finally securing approval in 2023 after overcoming numerous delays. This timeline underscores the need for CASPs to start preparing for compliance, ensuring they are proactive and well-prepared for the changes ahead.

Before MiCA, the EU grappled with a significant gap- the absence of a specific legal framework for crypto-assets. CASPs operating in the EU had to comply with the various crypto regulations of 27 countries. This regulatory void exposed the market to fraud, manipulation, and financial instability. MiCA fills this void, providing clear legal standards that apply uniformly across all EU nations and legal clarity for the EU’s crypto space.

The Global Impact and Future Prospects of MiCA on Crypto Regulation

The European Union is leading the way in setting regulatory standards for the crypto industry by introducing the Markets in Crypto-Assets (MiCA) framework. This framework is becoming increasingly influential globally, much like the impact of the General Data Protection Regulation (GDPR). MiCA’s importance in setting future benchmarks for the crypto industry worldwide is growing, and it is crucial for all crypto-asset service providers (CASPs) currently operating or considering operations within the EU to comply fully with MiCA by the end of 2024.

The Global Impact and Future Prospects of MiCA on Crypto Regulation

The European Union is leading the way in setting regulatory standards for the crypto industry by introducing the Markets in Crypto-Assets (MiCA) framework. This framework is becoming increasingly influential globally, much like the impact of the General Data Protection Regulation (GDPR). MiCA’s importance in setting future benchmarks for the crypto industry worldwide is growing, and it is crucial for all crypto-asset service providers (CASPs) currently operating or considering operations within the EU to comply fully with MiCA by the end of 2024.

Navigating MiCA Compliance With Ospree

Due to its breadth and depth, compliance with the Markets in Crypto-Assets (MiCA) regulation can appear daunting. However, your business can achieve compliance efficiently and effectively with strategic planning and the right tools. Here’s a streamlined approach to tackling MiCA requirements and how Ospree can simplify this process for your business:

Preparing for Compliance

- Custody and Security: CASPs providing custody services must implement stringent security measures for asset safekeeping. This includes segregated client holdings, daily asset reporting, and full accountability for losses resulting from operational failures or security breaches.

- Management of Client Funds: CASPs must deposit client funds with a central bank or a qualified credit institution at the end of each business day, ensuring the safety and liquidity of these assets.

Implementing Compliance Solutions with Ospree

Simplicity: Ospree offers bespoke B2B solutions that transform complex compliance requirements into straightforward, manageable tasks. This efficiency enables your team to focus on growth and development while Ospree handles the intricate aspects of compliance.

Flexibility: The platform’s adaptable nature allows for rapid modification of compliance strategies across multiple jurisdictions, minimizing disruption to your operations.

Scalability: As your transaction volumes grow, Ospree’s platform scales accordingly, ensuring continued efficiency, cost-effectiveness, and security.

Ospree for Strategic Advantage

For companies worldwide, navigating MiCA regulations is necessary for business operations, and doing so effectively and efficiently is a strategic asset. Ospree simplifies the complexities of compliance ecosystems by integrating and streamlining essential processes, such as monitoring crypto asset transactions and implementing the Travel Rule. This comprehensive support ensures that your business remains secure and efficient as it expands, turning regulatory compliance into a competitive advantage in the marketplace.

References

“Document L:2023:150:TOC.” Official Journal of the European Union, L 150, 9 June 2023. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=OJ:L:2023:150:TOC

Di Salvo, Mat. “EU Lawmakers Pass Landmark Crypto Assets Regulation Bill.” Decrypt, 10 October 2022. https://decrypt.co/111583/european-union-lawmakers-pass-crypto-regulation-bill

“Digital Finance.” Council of the European Union, 1 July 2022 (last reviewed), https://www.consilium.europa.eu/en/policies/digital-finance/

“MEPs from @EP_Economics voted to confirm w/ 28/1 provisional deal on markets in crypto assets #MICA @DrStefanBerger ahead of the final plenary vote.” Twitter, 10 October 2022. https://twitter.com/EP_Economics/status/1579501816508604416?s=20&t=y4vRMxUqOxPdIW1kgcCM9g

“Press Release – Digital finance: agreement reached on European crypto-assets regulation (MiCA).” Council of the European Union, 30 June 2022, https://www.consilium.europa.eu/en/press/press-releases/2022/06/30/digital-finance-agreement-reached-on-european-crypto-assets-regulation-mica/

“Press Release – Digital Finance Package: Council Reaches Agreement on MiCA and DORA.” Council of the EU, 24 November 2021, https://www.consilium.europa.eu/en/press/press-releases/2021/11/24/digital-finance-package-council-reaches-agreement-on-mica-and-dora/

Proposal for a Regulation of the European Parliament and of the Council on Markets in Crypto-assets, and amending Directive (EU) 2019/1937 (MiCA) – Letter to the Chair of the European Parliament Committee on Economic and Monetary Affairs. Council of the European Union, 5 October 2022. https://data.consilium.europa.eu/doc/document/ST-13198-2022-INIT/en/pdf

Schickler, Jack. “EU Delays Vote on MiCA Crypto Legislation Until February.” Coindesk, 7 November 2022 (last updated). https://www-coindesk-com.cdn.ampproject.org/c/s/www.coindesk.com/policy/2022/11/04/eu-delays-vote-on-mica-crypto-legislation-until-february/?outputType=amp

This material is for informational purposes only. It is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Ospree has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.